Components of a pharma and biotech go-to-market strategy

Completing the drug development process and getting FDA approval to go to market with a new drug is a major accomplishment in itself, but this does not guarantee the commercial prosperity of the new product. To assure launch success, rapid adoption by prescribers and use by patients requires a well-thought-out commercial strategy with multiple components.

At Herspiegel we have partnered with biotech and pharma companies big and small and have successfully brought millions of dollars worth of drugs, devices, and treatments to market. But before a product goes out the door, we help launch teams set their go-to-market strategies. There are four components to each of our product launch strategies:

- Where to play?

- How to win

- How to execute

- The launch plan

Expectation levels of the patient population have changed which means marketing needs to adapt as well. Marketers have to do a better job of educating consumers about new drugs and treatments before they are launched in the marketplace. They also need to recruit patients and prescribers before the launch, which means they have to get the right information out to the right audience. After launch, they have to continue to support the customer journey by making sure the patient’s needs continue to be met during the entire length of the treatment.

Today, less time is spent traveling for in-person meetings and more time is spent in front of the screen, which means that companies have to adapt how they set up their field force. How can reps engage physicians beyond office visits? Ultimately, this is what the launch teams need to answer when developing the ‘how to execute’ portion of their strategies.

Drug launch programs coupled with the right launch teams give companies an advantage when bringing their product to market. In this post, we cover our thoughts and process for the ‘how to execute’ portion of a go-to-market strategy.

Part 3: How to Execute

There are four main elements to how we help our clients execute their go-to-market strategies:

- Market Development

- Tactic and Resource Plan

- Field Force Sizing

- Infrastructure Development

1. Market Development

After assessing the market, creating a market map, and doing customer segmentation and profiling, we take the brand strategy that we created with our client and start introducing the new product to the marketplace. Using our well-developed understanding of the customer journey we can now show the value of the drug or treatment through marketing.

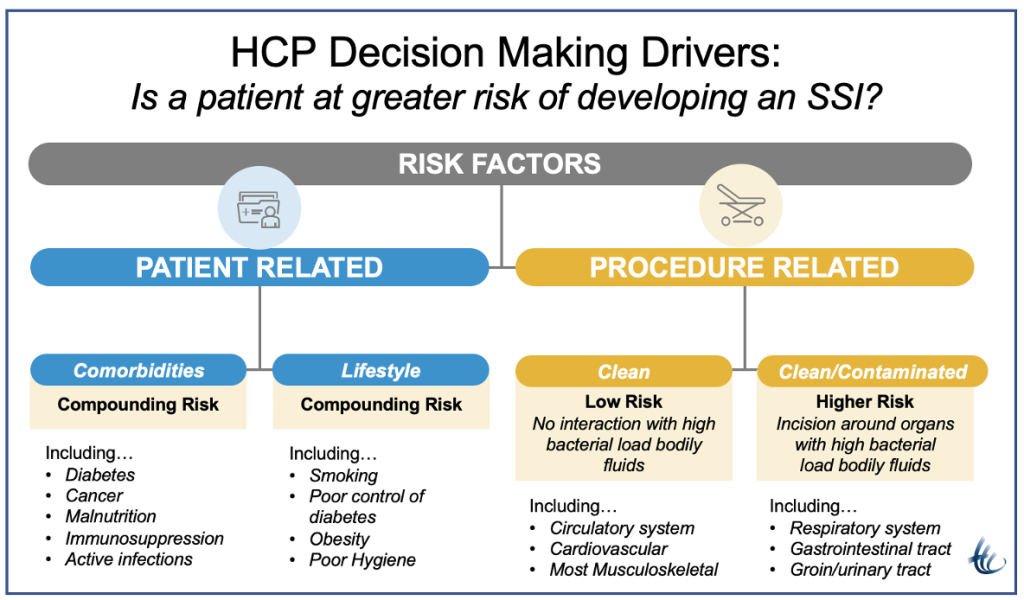

For example: One of our clients needed to achieve a deeper understanding of the customer journey for their product. They wanted to know how their product impacted patients in a clinical setting and what needs, if any, were currently unmet. To do this, they had to find out what the HCP’s thoughts and experiences were for surgical site infections in the surgical setting. This included how comorbidities and lifestyle contributed to risk and what teams could do to mitigate them. The client was interested in objectively assessing available competitive treatments and emerging solutions.

To accomplish this, we proposed and led a two part research engagement. First, through primary qualitative research, the team sourced insights from the community and academic settings that led to a risk stratification matrix identifying such variables as setting, patient and surgery type, and event severity. To complement the qualitative research, quantitative research sought to elucidate what truly drove HCP decision making. The client ultimately had a comprehensive view of stated and derived barriers to adoption and what product-level attributes customers valued most.

With the general population having more access to information about healthcare than ever before, including their own medical health data, they can now research their symptoms and discover available treatments. For this reason, brands need to expand the conversation around their products to include clinical benefits and improved health outcomes.

Marketers also need to present value-added content to their consumers to differentiate their brand’s value proposition. Brand marketers at pharma companies need to seize the opportunity to reach patients directly, not just the providers, with their marketing outreach, which could prompt requests from patients for new products or treatments, increasing market penetration and directly impacting sales.

When writing market development plans, these marketing and brand awareness activities should be included

- Engagement with stakeholders, educating them on treatments available and the associated diseases

- Leveraging the right mix of digital and physical channels

- Information and training sessions both in-person and online

- Building brand awareness and establishing them as a trusted entity in the disease community

- Increasing visibility through the company’s website

2. Tactic and Resource Plan

Sales representatives for pharmaceutical companies need to build new capabilities for managing virtual sales visits in addition to in-person visits. While online sales visits can’t replace face-to-face interactions, reps can learn to listen and gain insights into physicians’ and patients’ unmet needs. They will also need to rethink marketing materials that are more self-explanatory to work in fully remote settings and in-person meetings. Tactical programs will include training staff with soft and hard skills like empathetic interaction and using digital tools to adjust to a more remote product launch environment.

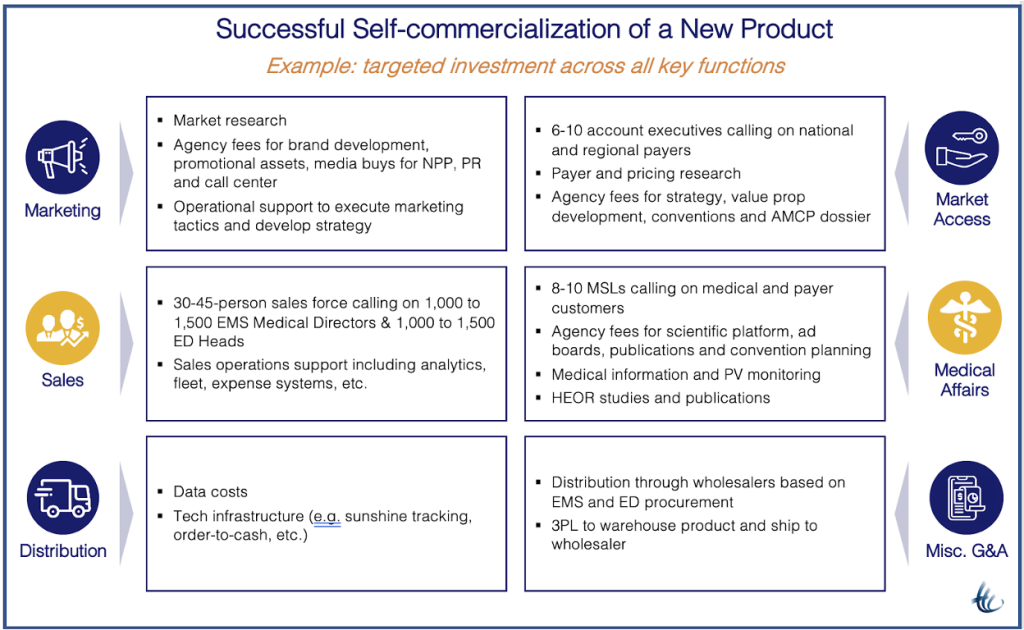

Tactical planning for launch teams gives companies an opportunity to reassess the set-up of their field force. If reps need to spend less time traveling to see HCPs or promoting their products at live events, they have increased capacity to pursue value-added opportunities. One example might be expanding beyond the treatment network by reaching out to pharmacy benefit managers and insurance companies, health systems, physician networks, advocacy groups, and governmental agencies.

Creating a better more targeted virtual experience

There is a new opportunity with online channels to give HCPs interesting and useful content in easy to consume formats through virtual channels. Short videos and easy to read material can serve as training for new products or treatments. Also, online formats can be shared with other members of the team who could be new to the organization and might have missed the opportunity for in-person training. Follow up meetings could be set-up to discuss the content, allowing the sales organization to have additional touch points with their sales targets.

The value story can be customized and tailored to distinct customer groups, through a variety of different, yet integrated, personal and non-personal channels.

Moving to a more virtual engagement approach is highly beneficial but it requires launch teams to evaluate their content/ collateral so that it is designed to be “customer-centric” and capture customer attention. There is so much competition for people’s time, especially online, that product content has to be especially relevant and meet the customer’s priorities in order for them to engage. Launch teams need to take into consideration who they are talking to and targeting with the content they are creating, and that it is appropriate for those on the receiving end.

3. Field Force Sizing

Pharma companies have a lot to consider when deciding how much time and effort is necessary to find, hire, and train the field force. Knowing the challenges of finding the right people, how to retain the acquired talent must also be considered. Calculating how much sales force you can afford requires some thought into a variety of factors. These include:

- Sales forecasts

- Profitability goals

- Investments

Building a commercial footprint through a field force can be a challenging endeavor for both established and new market entrants. The exercise takes into consideration a myriad of assumptions as the field team needs to be solution agnostic and reflective of the HCP prescriber base. At the uppermost end of the funnel, the company assesses market opportunities by the number of potential prescribers, then breaks them down by primary care and/or specialty. Applying decile-based filters, teams can hone in on segments that are most likely to be promotionally sensitive.

Successful teams have driven ownership down to the professional representative level by engaging field based teams to collaborate on reach and frequency expectations, as well as field typing tools that aggregate prescribing behavior. These approaches can contribute to HCP segmentations that are both behavioral and attitudinal.

Traditional field based teams have been structured based on ratios of representatives to customers, reps to managers, and managers to directors. In the post-COVID era considerations like channel structure and promotional sensitivity require exploration. Herspiegel has partnered with established players and small biotech clients alike to explore/ identify opportunities for internal teams (e.g., tele-depth sales) to complement traditional engagement models in order to cover both in person and virtual sale opportunities.

4. Infrastructure Development

Once your product is launched in the marketplace you need to have a strategy for sustaining adoption and growth. If a drug or treatment addresses a fundamental problem then it creates real value to the payer as well as the prescriber. These products can grow sustainably because they offer a solution to their users. As long as the drug or treatment continues to offer a unique solution it will continue to grow organically, even if competition or market saturation slows it down a little. It is likely that the product can retain a large percentage of users if pharma companies develop the following infrastructure:

- Educate the audience using omni channel communication by tailoring campaigns to their preferred devices. Access to information is simpler than it used to be and physicians lack the time to educate patients. Patients have turned into active ‘consumers’ and, in the process, become more self-reliant.

- Patient awareness, education, and training: Patients might cease therapy early when their symptoms subside. If they relapse they could blame this on poor-quality medication. Education and training can motivate adherence and brand loyalty.

- Measure engagement, impacts and knowledge retention, in order to make quick strategic decisions.

If your launch team has been successful then your drug or treatment has product-market fit and net growth. High growth without retention (product-market fit) or high retention without growth are not sustainable in the long term.

Summary

The product launch landscape has seen quite a few challenges and innovations in the last couple of years, the most impactful of these is the move to remote launch activities. Pharma companies are forced to gear up for virtual meetings and product training by helping their sales reps build new capabilities that can enhance launch success. Virtual calls replace many in-person visits, and reps will learn to create their own sense of proximity with HCPs using cameras, screen sharing, and other interaction tools.

Pharmaceutical companies that know how to execute their product launches don’t overlook any of the launch components discussed here. These components include market development, tactic and resource planning, field force sizing, and infrastructure development.

‘How to Execute’ is the third step in developing an effective go-to-market strategy for your next product launch. Stay tuned for the fourth of four posts, where we will discuss additional elements for a successful go-to-market strategy, ‘The Launch Plan.’