Components of a pharma and biotech go-to-market strategy

Getting product launches right is more critical than ever before. The Food and Drug Administration (FDA) approved 50 new drug therapies for 2021 and the accelerated pace looks to continue for 2022. Pharma companies navigating the launch of new products have to also optimize strategies around access to physicians, digitalization, more informed and demanding patients, and intense competition. Faced with these challenges, pharma companies must enhance and fine-tune their launch planning and execution process to ensure successful launches of strong products.

At Herspiegel we have partnered with biotech and pharma companies big and small and have successfully brought millions of dollars worth of drugs, devices, and treatments to market. But before a product goes out the door, we guide launch teams in how to develop and build their go-to-market strategies. There are four components to each of our product launch strategies:

- Where to play

- How to win

- How to execute

- The launch plan

Pharma companies that have product launches that repeatedly perform beyond expectations know how to develop vision and positioning, create a brand strategy with notable differentiation, and focus on building superior customer experiences. They know ‘how to win’ by treating their drug launches as a micro-battle.

Part 2: How to win

New product launches in the pharma industry face intense competition. The industry is more calculated in its pursuit of novel mechanisms of action for beachhead and follow-on indications. As a result, the average window of time in which a drug remains in the market before competitor products arrive has dropped from approximately eight years to less than five years. This onslaught of new drugs makes it highly challenging for pharma companies to use Phase III clinical trial data alone to differentiate their drug in front of physicians, health insurers, and regulators. Companies can ensure success in the case of a new product launch only if they are adept at communicating both the clinical and non-clinical benefits of a new product to physicians and decision-makers.

What do pharma companies need to know before engaging in these micro battles with their new products or treatments? These are the four elements we cover with our clients to make sure they win at their product launches:

- Target product profile (TPP) and value profile

- Vision and Positioning

- Brand Strategy

- Forecast (KPIs that will define success)

1. Target product profile (TPP) and value profile

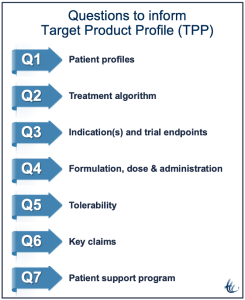

A target product profile (TPP) outlines the desired ‘profile’ or characteristics of a target product that is aimed at a particular disease or diseases. TPPs state intended use, target populations, and other desired attributes of products, including safety and efficacy-related characteristics. The TPP is used by launch teams for vision and focus and to guide the decision-making process.

When drafting and updating the TPP, the process is as important as the document. The collaborative, cross-functional process provides an opportunity to identify, describe, and resolve misalignments that can doom the product. For example, it is up to marketing to point out that simply being new is not sufficient. What are the advantages compared to competing treatments? The novel is not good enough.

2. Vision and positioning

When going to market with a new drug there needs to be a strong value proposition to convince payers of the drug’s clinical, economic, and societal benefit in the wider treatment landscape. Most importantly, with rising competition and costs, the patients need to know that the treatment benefits will be worth the economic cost.

When defining a value proposition it is important for pharma companies to clearly define who the new treatment will benefit. This enables them to effectively communicate to the right target audience about the overall benefits of the treatment and make sure that the message resonates with them. Often it is beneficial to conduct market research to understand and gain insight into how payers view the value proposition of current and Phase III treatments and whether the benefits from the drug or treatment would equal it’s price.

3. Brand Strategy

Product launch teams need to agree on a basic brand strategy for the product in order to ensure that all teams will be executing tactics that ladder up to the overarching strategy. To achieve a brand strategy that will lead to launch success, companies need to build out the following components:

- Product differentiators: Identify unique features of the drug or treatment to ensure that it has a unique selling proposition within its market and distinguishing it from a competitor. Differentiation can be a challenge in the pharmaceutical market, most strategies often include differentiators based on price, message, brand perception, and services. Incremental innovation, copycat products, and top-selling drugs or treatments are no longer enough for today’s savvy consumer. New products must demonstrate that their brand adds value and improves the patient experience. The use, effects, and side effects might be the same for a generic and brand name drug but sometimes a brand name drug might have a perceived quality benefit for being first to market or the generic drug might have better packaging and perceived value.

- Research informed positioning: The value proposition should be backed up with solid research data. Engaging with stakeholders early (as early as Phase 1) helps commercial teams understand what value means to each stakeholder. Understanding your target audience helps guide the decision-making for opportunity and risk trade-off. It also lends valuable insight when determining the precise value proposition and in-scenario planning.

- Refined customer segmentation: Not knowing the size of your audience makes it impossible to measure success accurately. Defining your target (real and potential) is essential from a clinical and commercial viewpoint.

Cross-functional launch team meetings will help promote necessary communication prior and post launch. At these meetings launch team leads will discuss tactical execution of strategy and understand how the activities of one team can affect the planning and tactics of another.

Recent launches in the autoimmune space have seen novel mechanisms of action (MOAs) differentiate themselves from biologics. By adopting a “Blue Ocean” strategy, their positioning is grounded in safety and convenience. HCP and patients provided insights that led to an understanding that not everyone is a candidate for a biologic. By introducing this “pre-biologic” space, new MOAs were able to drive adoption and distance themselves from competitors focused on efficacy.

Brand strategy and launch teams must be flexible and ready to pivot based on the outcome of any event. Various clinical, regulatory, trade, and commercial scenarios should be considered so that teams can prepare for all launch related outcomes.

4. Forecast: KPIs that define success

Every product launch is different, which means the KPIs you use to measure the success will likely be different from those of another company and or product. The goal of an effective KPI system is the ability to track and benchmark performance regularly and consistently across teams. Good KPIs should consist of insightful and actionable metrics, clear definitions and benchmarks, and a reporting process that aligns the entire launch team in defining success.

Most pharmaceutical companies will track their drug launch performance using sales share and growth, which are the most conventional metrics but not the only metrics that should be measured if you want to ensure success. Examples of other KPIs brands should be using include:

- Brand impact in the market: For example the number of KOLs reached, publication share of voice, degree of noise in the media, level of patient groups engaged, etc..

- Patient Journey: How many patients have been diagnosed, how many patients have been treated, and how many patients have switched treatments.

- Doctor engagement: What percentage of doctors are engaged with, talked to, and at what frequency they are reached. Which doctors are early adopters for a drug, which are not?

It is important to ensure that the chosen KPIs are aligned with the overall product launch strategy, concentrating only on those that will make a difference. They should include pre- and post-launch KPIs, as well as measures that are strictly launch-independent, focusing on such areas as disease awareness and education, scientific publications, and KOL contacts.

Summary

The product launch landscape has seen quite a few changes, both challenges and innovations, in the last couple of years. This includes increased competitive intensity, using social media to influence payers, and reduced access to physicians. Agility has become a key ingredient to the more complex launch landscape as the healthcare environment has become much more dynamic and diverse.

Pharmaceutical companies that know how to win at product launches don’t skip out on any of the launch components discussed here. These components include: TPP, vision and positioning, brand strategy and forecasting using KPIs.

Defining ‘how to win’ is the second step in developing an effective go-to-market strategy for your next product launch. In our third of four posts we will discuss additional elements for a successful go-to-market strategy. Up next, ‘How to Execute: Develop and resource your go- to-market strategy.’