How the BBBA intends to lower drug costs

The Build Back Better Act (BBBA) drug pricing framework is being closely followed by the industry. The Build Back Better Act narrowly passed through the house on November 19th and currently sits with the Senate. All the proposed healthcare updates in the Build Back Better Act would need approval by the senate, prior to going into effect. For this reason, It’s likely there will be significant changes to the bill prior to being fully approved by the senate.

Meanwhile, price hike caps under the framework would roll out in 2023. The caps would be tied to the rate of inflation, and the rule would apply to commercial insurance coverage, too.

What does this mean for pharma companies getting ready to launch their products in 2022? A new pricing strategy? It could ultimately entice drugmakers to boost their prices at launch.

The Build Back Better Act, introduced in the House of Representatives has the goal of bringing down costs. There are five ways this can happen:

1. Changes to the noninterference clause

They would change the noninterference clause—which prevents Medicare from negotiating Part D drug prices between drug manufacturers and prescription drug plan sponsors—to allow the federal government to negotiate drug prices for therapies that are expensive and that do not have a generic or biosimilar alternative with Medicare Part B and Part D coverage.

This would kick off in 2025 with a focus on the ten most expensive Medicare prescriptions, followed by fifteen other prescriptions in 2026 and 2027 and twenty prescriptions in 2028 and beyond. Most drugs would not be affected by the negotiations.

In addition, under current law, the Secretary of HHS does not negotiate prices for drugs covered under Medicare Part B. Instead, Medicare reimburses providers based on a formula set at 106% of the Average Sales Price (ASP).

The Part D non-interference clause has been a longstanding target for some policymakers because it limits the ability of the federal government to negotiate lower prices. With the rise in high-priced drugs coming to market, there is renewed interest in proposals to allow the federal government to negotiate drug prices for Medicare beneficiaries.

2. Manufacturers would pay rebates for price increases above inflation

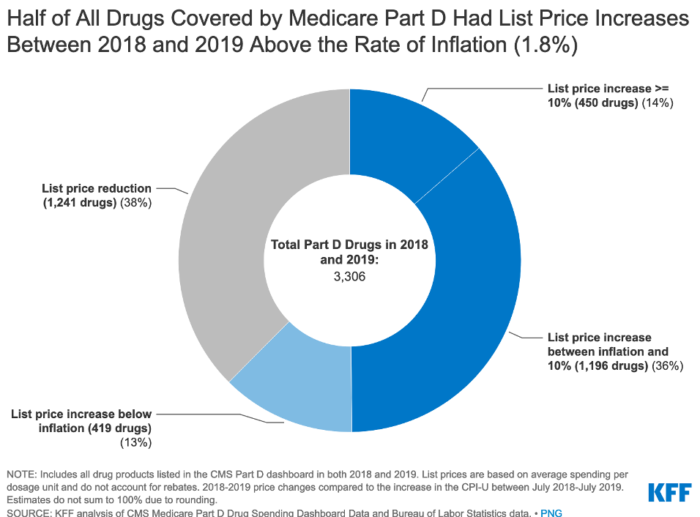

Under the current law, Medicare has no authority to limit annual price increases for drugs covered under Part B or Part D. In contrast, Medicaid has a rebate system that requires drug manufacturers to provide refunds if prices grow faster than inflation. Annual drug price increases exceeding inflation are not uncommon and affect people with both Medicare and private insurance. Half of all covered Part D drugs had list price increases that exceeded the rate of inflation between 2018 and 2019 (which was 1.8%).

Beginning in 2023, the Build Back Better Act would demand that drug manufacturers pay a rebate that exceeds the inflation rate for many single-source drugs and biologicals that Medicare would cover. Inflation rebates could save $36 billion or up to $82 billion, based on recent Congressional Budget Office (CBO) analysis.

BBBA would make drug manufacturers pay a rebate to the federal government if their prices for single-source drugs and biologics covered under Medicare Part B, and nearly all covered drugs under Part D, increase faster than the rate of inflation. Under these provisions, price changes would be measured based on the average sales price (for Part B drugs) or the average manufacturer price (for Part D drugs).

What this means for drug manufacturers planning to launch drugs in 2023 is that they would effectively have to rebate to the government any revenues from price increases in excess of inflation in Medicare or private insurance plans. Manufacturers who do not pay the requisite rebate amount would be required to pay a penalty equal to at least 125% of the original rebate amount. The base year for measuring cumulative price changes relative to inflation is 2021. Definitely something for pharma companies to consider when looking at their current pricing strategies.

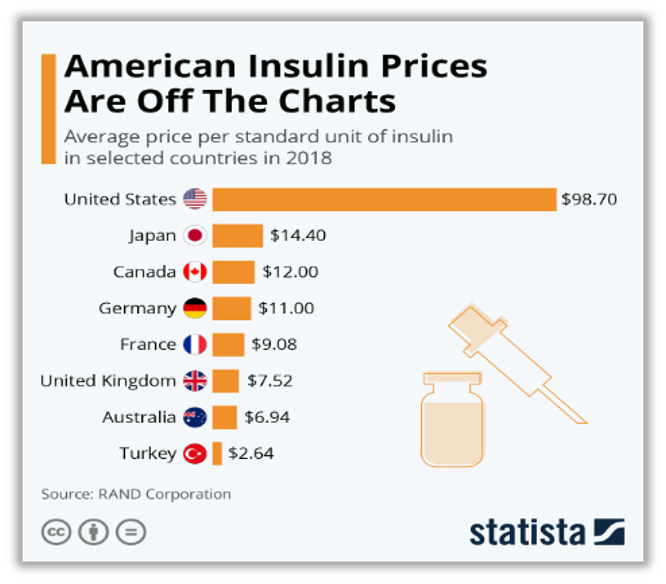

3. $35 insulin product copay limit for both public and private insurers

For Medicare beneficiaries with diabetes who use insulin, coverage is provided under Medicare Part D. Because Part D plans vary in terms of which insulin products they cover and how much they cost, what enrollees pay for insulin products also varies.

BBBA law would limit cost-sharing for insulin to $35 for all Part D plans. This means private group or individual plans would not be required to cover all insulin products, just one of each dosage form and insulin type. Paying a flat $35 copayment rather than 25% coinsurance or a higher copayment amount could reduce out-of-pocket costs for many insulin products. These provisions are also expected to provide savings to millions of insulin users with private coverage. Like the rebates, this part of the law would take effect in 2023.

4. All preventative vaccines will be free of charge starting in 2024

Currently Medicare covers vaccines under both Part B and Part D. This separation of coverage for vaccines under Medicare is because there were statutory requirements for coverage of a small number of vaccines under Part B before the 2006 start of the Part D benefit. Vaccines for COVID-19, influenza, pneumococcal disease, and hepatitis B are covered under Part B. All other commercially available vaccines needed to prevent illness are covered under Medicare Part D.

For vaccines covered under Part B, patients currently face no cost sharing for either the vaccine itself or its administration. Unlike most vaccines covered under Part B, vaccines covered under Part D can be subject to cost sharing, because Part D plans have flexibility to determine how much enrollees will be required to pay for any given on-formulary drug, including vaccines.

Under BBBA Medicare Part D plans would have to cover all vaccines free of charge starting in 2024 for all vaccines that the Advisory Committee on Immunization Practices (ACIP) recommend.

5. Repeal of the November 2020 drug rebate rule

The BBBA would prohibit implementation of the November 2020 final rule issued by the Trump Administration. This rule would have eliminated rebates negotiated between drug manufacturers and pharmacy benefit managers or health plan sponsors by removing the safe harbor protection currently extended to these rebate arrangements under the federal anti-kickback statute.

This rule was going to take effect on January 1, 2022, but the Biden Administration delayed implementation to 2023 and the infrastructure legislation signed into law on November 15, 2021 includes a further delay to 2026.

In Summary

These updates aim to lower the costs of the drugs themselves and the speed at which prices increase, but not only that they also aim to shift the burden on the insurance companies and government.

In order for all these proposed price decreases to happen the Build Back Better Act needs to be approved by the Senate. While most of these changes will not immediately affect most drugs on the market, pharma companies should be keeping a close watch on what comes next.